India's Most Trusted Digital Chit App

Save, Earn & Borrow Smartly with India’s no. 1 Digital Chit App. Plans starting with just Rs. 2000/- per month

Want to connect with chit advisor ? Click Here!

Guaranteed Returns

Earn a fixed interest rate of 12% per annum for savers

Instant Access to Funds

Receive your prize money within 7 working days

Simple & Convenient

Anytime, anywhere, hassle-free, 100% digital chit app.

Trusted & Transparent

Registered & Regulated by Registrar of Chits, Govt. of India

Latest Chit Plans

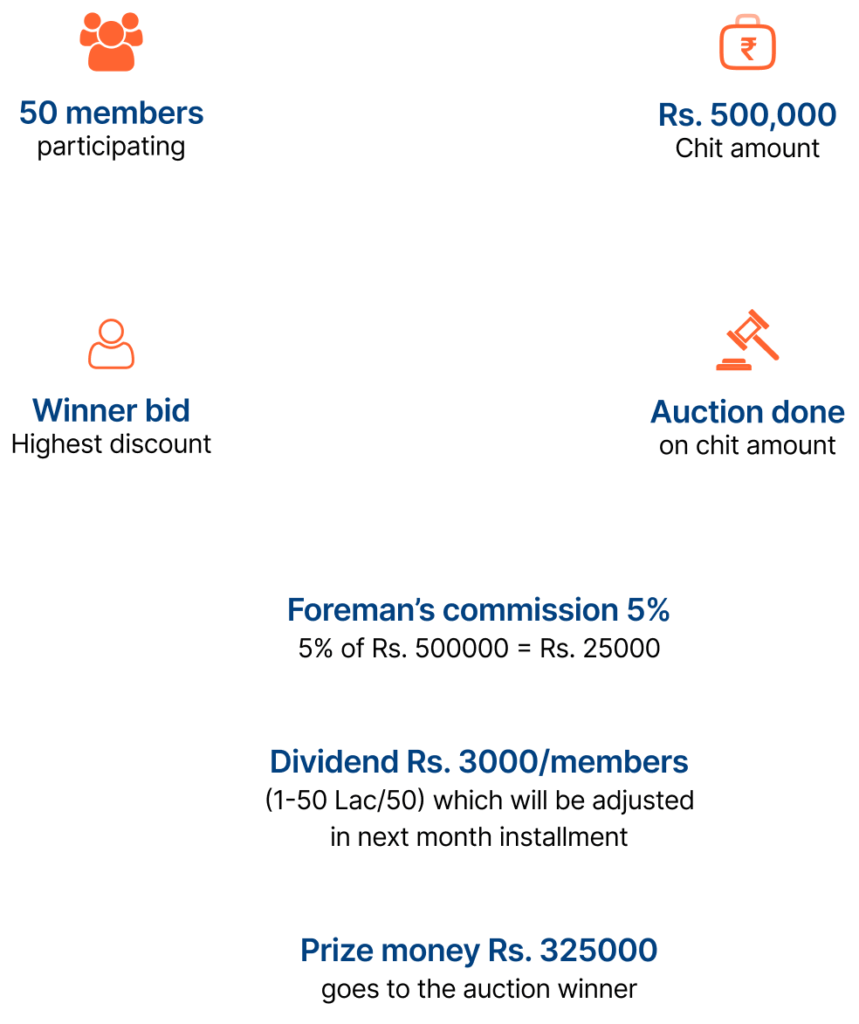

- How Chit Works?

Grow With Us

11.5% +

Avg. Returns

400 Cr +

Commited Savings

100 Cr +

Auction Turnover

20,000+

Chit Subscribers

1.5 Lakh+

App Users

20+

Physical Branches

myPaisaa Advantage

Our digital savings app offers you a superior experience through quick and easy payouts, transparent transactions and customer-first processes.

2 Min Onboarding & 24 hrs. Payout

In App Live e-Auctions from app

4-10 auctions per month

In-app one click customer support

Fully compliant as per the “Chit Fund Act 1982”

Chit Plans for Everyone

What our members say?

The app is very nice. Dheeraj helped me a lot in getting the account activation, and the support he provided was

excellent. I got the chit amount credited to my

account easily.

~Thirpathi Badam

One of the best online chits that we can trust and invest. Service is also very good. My relationship manager Ravibabu helped me at all the stages.

~V K Sandeep

Thank you for all your help at the time of need. I really appreciate the support of Dheeraj and team for all your efforts.

~Mausumi Das

Thanks to myPaisaa and special thanks to Kushboo who explained all its benefits and encouraged me to join. All the very best to myPaisaa team.

~Suthanand S

Amazing app. On-time

credits of the winning amount and dividends. Very fast processing, I would recommend to everyone and I rate this as the best financial app.

~Lokanath PH

Best financial app in the market compared to other chit fund companies. Hassle-free process and minimum documentation!

~Dev Kuchana

20+ myPaisaa Seva Kendras

myPaisaa has 20+ centres spread across Telangana, Karnataka & Andra Pradesh. We call them “Seva Kendras”

myPaisaa Centres

Hyderabad | Secunderabad | Ramnagar | Sangareddy | Warangal | Nizamabad | Janagam | Cheriyal | Siddipet |Khammam | Guntur | Vijaywada | Eluru | Vizag | Vizianagaram | Srikakulam | Palasa | Bengaluru | Mysore | Tumkur | Kunigal

Frequently Asked Questions

What are the advantages investing in Chit?

There are 4 main advantages of investing in chit funds:

- Chit fund is the only financial instrument that allows customers to save and borrow from their own funds.

- Chit funds are one of the oldest forms of investments used by households to grow their money. Today, with FDs and RDs offering low interest rates of 5-6%, chit funds have become a much more attractive investment that offer more returns, and more value for money.

- Chit funds bring discipline to both the saving and borrowing activities of individuals. While the money you set aside for chit funds maybe low, you’ll definitely see steady growth and a clear path to achieving your financial goals.

- Borrowing through chit funds is very easy and effective. As you’re essentially borrowing from your own savings, the rate of interest is lower than market rates and can be as low as 0% depending on when you borrow from your plan. Chits are a reliable source of funds for emergencies.

How much returns can I get from investing in chit?

Chit fund returns depend on the month you participate in and win an auction. A customer who stays for the entire duration of chits an annual interest of around 10 to 12%.

What is the duration of chit plan?

We offer durations ranging from 12 months to 50 months.

What is the difference between traditional chit vs digital chit?

Traditional chit fund companies operate using traditional, complicated manual processes. Customers are required to visit chit fund offices in order to participate in auctions, leading to the loss of valuable time and energy.

With digital chits, you can enjoy all the benefits of a traditional chit fund at your convenience. Digital technology has also automated the entire process making chit funds much more transparent, reliable and easy for the millennial customers of today.

How safe is my investment with myPaisaa?

myPaisaa powered by Bilva echits and IBG echits is a registered chit with state Govt. Registered chit funds are regulated by the Government of India. A registered Chit Fund Company makes a security deposit of a sum equal to 100% of the chit value into a Scheduled Bank as FDR, which is pledged in favour of the Registrar of Chits. A Chit Fund cannot be started unless this deposit is made. Therefore, as a participant in a registered Chit Fund Company you can be rest assured that your investments are secure.

Why shouldn't I invest in mutual funds instead of myPaisaa

Mutual funds and chit funds serve different purposes. Mutual funds are long-term investments directly linked to market performance. There’s no guarantee of you getting your principal amount back or making profits. Chit funds on the other hand, have zero market risk. They are a great tool for guaranteed short-term investments that enable you to save steadily for your goals and emergencies. Also, unlike mutual funds, you can both save and borrow withChit funds.

Why should I invest in myPaisaa over FD & RD?

Recurring deposits offer low interest rates of 5-6% per annum. Also, if a customer withdraws from the RD before maturity they’re charged a penalty. Moreover, RD returns are taxable too. However, customers who save in chit funds can expect much higher returns – up to 10 – 12% per annum. They can participate in online auctions and get their money in advance. There’s the additional benefit of borrowing from your fund in case of emergencies. The best part about chit funds is that the returns are tax-free. Customers can enjoy the full value of their investments without any deductions.